In today’s fast-paced economy, relying on a single source of income can be risky. Diversifying your income streams is more important than ever for achieving financial stability and long-term security. The global economy is unpredictable, and having multiple sources of income can help you weather financial storms, capitalize on new opportunities, and ensure consistent cash flow.

In this article, we’ll explore the importance of diversifying income streams and share three compelling reasons why it should be a priority in your financial strategy.

1. Protection Against Financial Instability

One of the key reasons to focus on diversifying your income streams is to protect yourself against financial instability. Relying solely on one source of income, such as a traditional 9-to-5 job, can be dangerous. Job markets fluctuate, companies downsize, and unexpected life changes can lead to unemployment or reduced earnings.

By having multiple income streams, you reduce your reliance on any one source of revenue. Whether you lose a job or face a downturn in your business, other income streams can cushion the impact. Diversifying income streams can mean the difference between struggling to pay bills and maintaining financial security in tough times.

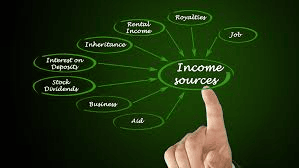

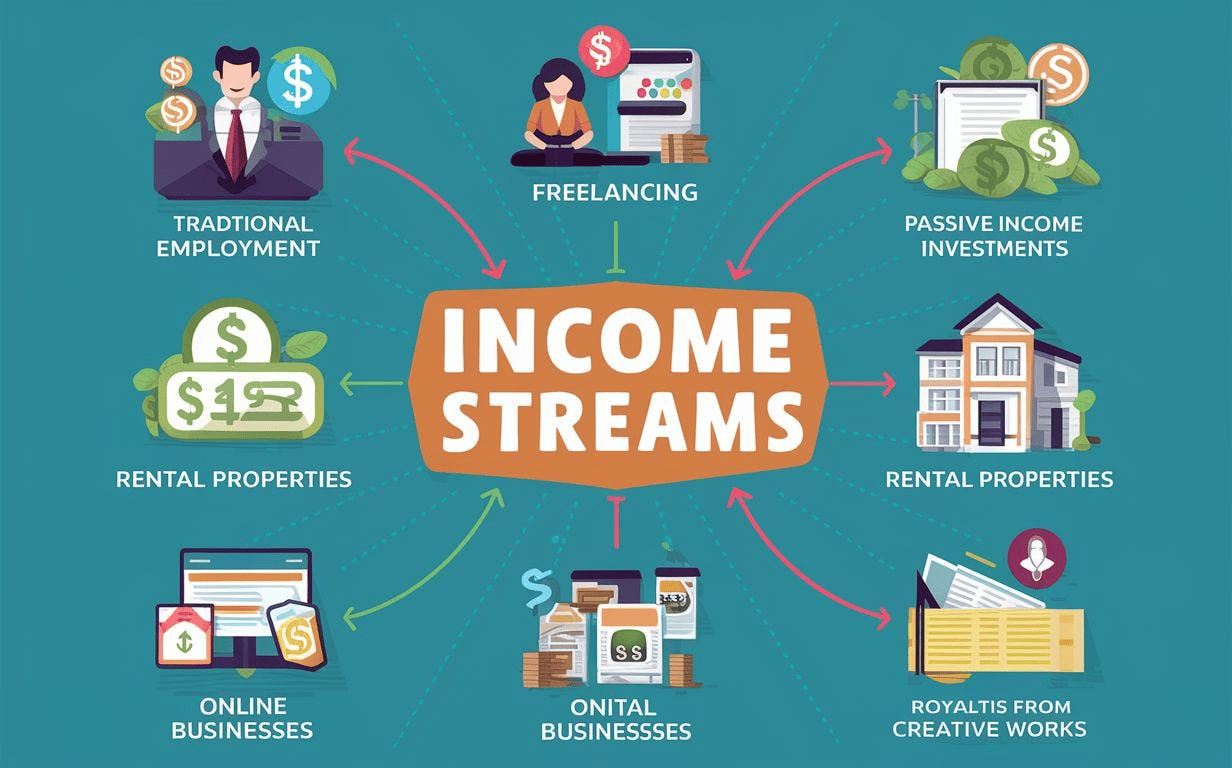

Subheading: Examples of Diversified Income Streams

Here are some examples of how you can begin diversifying your income streams:

- Investing in Stocks and Dividends: Build a portfolio of stocks that pays dividends, providing regular income.

- Real Estate: Rental properties can provide consistent monthly cash flow.

- Side Hustles: Freelancing, consulting, or starting a small business on the side can supplement your primary income.

- Passive Income: Investments in bonds, peer-to-peer lending, or creating digital products can offer a steady income with little ongoing effort.

Diversifying your income streams allows you to build a financial safety net, helping you stay afloat during uncertain times.

2. Opportunities for Wealth Building

The second reason diversifying your income streams is essential is the potential for wealth building. By creating multiple income sources, you can accelerate your wealth accumulation over time. Rather than waiting for incremental salary increases or bonuses from your primary job, other income streams allow you to take charge of your financial future.

For example, investing in real estate while earning income from freelance work can exponentially grow your wealth over time. When you combine earnings from different sources, you can save more, invest more, and compound your financial gains. Diversifying your income streams empowers you to take advantage of opportunities that might not be possible with a single source of income.

Subheading: How to Grow Wealth by Diversifying Income Streams

- Start Small: Don’t try to create multiple income streams all at once. Start with one additional source, like a side gig or investment, and build from there.

- Reinvest Your Earnings: Take the profits from one income stream and invest them into another, like real estate or stock portfolios.

- Automate and Scale: Look for ways to automate parts of your income streams, such as using passive income strategies that require minimal maintenance.

Diversifying income streams provides the potential for accelerated financial growth, giving you the opportunity to build a solid financial foundation.

3. Increased Financial Freedom and Flexibility

Another significant advantage of diversifying your income streams is the financial freedom and flexibility it provides. When you’re not dependent on a single income source, you have more control over how you manage your time, money, and career. This flexibility allows you to pursue passion projects, travel, or spend more time with family, all while maintaining a stable income.

For many, diversifying income streams means breaking free from the traditional 9-to-5 lifestyle. Having multiple streams of revenue gives you the option to work less at your main job while supplementing your earnings with other sources. This financial independence can open up a world of opportunities, from exploring new business ventures to achieving long-term personal goals.

Subheading: Diversified Income for Financial Flexibility

Here are ways that diversifying your income streams can provide more financial freedom:

- Pursue Your Passion: When you have multiple income streams, you can take the leap and work on something you’re truly passionate about without the fear of losing all your income.

- Retire Earlier: By investing and growing your income sources, you can reach financial independence faster, giving you the option to retire early if you choose.

- Enjoy Work-Life Balance: A diversified income stream gives you the flexibility to work on your own terms, reduce stress, and focus on what’s important to you outside of work.

Financial flexibility and independence are powerful benefits of diversifying your income streams, allowing you to live life on your own terms.

- Investing 101: Beginner’s Guide to Growing Your Money Safely

- 7 Smart Saving Strategies: How to Boost Your Savings Without Sacrificing Lifestyle

Conclusion

The importance of diversifying your income streams cannot be overstated. In a rapidly changing world, having multiple sources of income protects you from financial instability, opens up wealth-building opportunities, and provides increased flexibility and freedom in your life. By creating and maintaining diversified income sources, you not only safeguard your financial future but also position yourself for long-term success.

Take the first step today by exploring new income streams, whether it’s investing, side hustles, or passive income. Diversifying income streams is one of the smartest financial decisions you can make for both short-term stability and long-term wealth.