Investing is one of the most effective ways to build wealth over time, but if you’re just starting out, it can feel overwhelming. The good news is that with the right knowledge and strategies, you can start growing your money safely, even as a beginner. This Beginner’s Guide to Growing Your Money Safely will walk you through the essential steps to begin investing wisely and protecting your hard-earned money.

1. Understanding the Basics of Investing

Before diving into the stock market or any other financial venture, it’s important to understand what investing is and how it works. Simply put, investing involves putting your money into assets like stocks, bonds, real estate, or mutual funds with the goal of making a profit over time. A Beginner’s Guide to Growing Your Money Safely starts with knowing the core principles:

- Risk vs. Reward: Every investment carries some level of risk, but the key is to balance your portfolio with low-risk and high-reward opportunities.

- Time Horizon: The longer you’re able to leave your money invested, the more opportunity it has to grow due to compounding interest or returns.

- Diversification: Spreading your investments across different asset classes helps reduce risk and ensures you’re not relying on just one source of returns.

By understanding these fundamental principles, you can grow your money safely and make smarter investment decisions.

2. Set Clear Financial Goals

One of the first steps in the Beginner’s Guide to Growing Your Money Safely is to define your financial goals. Knowing what you want to achieve will help guide your investment strategy. Here are a few things to consider:

- Short-Term Goals: Do you need the money in the next few years for something like a home down payment or a vacation? If so, you’ll want to choose safer investments like bonds or high-yield savings accounts.

- Long-Term Goals: If you’re investing for retirement or other long-term needs, you can afford to take on more risk, such as investing in stocks or real estate.

- Emergency Fund: Always set aside 3-6 months of living expenses in a savings account before investing. This ensures you have a safety net for unexpected financial situations.

By setting clear goals, you’ll know how much risk you can tolerate and what investment options are best for growing your money safely.

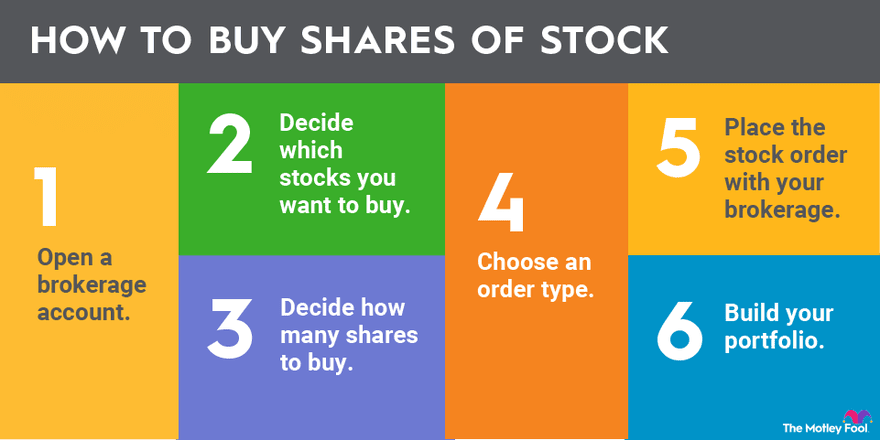

3. Choose the Right Investment Accounts

Choosing the right account is crucial for growing your money safely. There are several types of investment accounts, each with different benefits. This Beginner’s Guide to Growing Your Money Safely highlights the most common options:

- Individual Retirement Accounts (IRAs): These accounts are ideal for retirement savings and offer tax advantages.

- 401(k) Plans: Offered by employers, these accounts often come with matching contributions, making them a great option for growing your wealth.

- Brokerage Accounts: If you want more flexibility, a standard brokerage account allows you to invest in stocks, bonds, ETFs, and more. However, these accounts don’t offer the same tax benefits as retirement accounts.

Selecting the right account ensures that your money can grow tax-efficiently, helping you grow your money safely over time.

4. Build a Diversified Portfolio

A key strategy in any Beginner’s Guide to Growing Your Money Safely is diversification. Diversification means spreading your investments across various asset classes to minimize risk. Here are a few asset types to consider:

- Stocks: Offer the highest potential for long-term growth but come with more risk.

- Bonds: Typically safer than stocks, bonds provide steady income and are good for preserving capital.

- Exchange-Traded Funds (ETFs): These funds hold a collection of stocks or bonds and offer diversification within a single investment.

- Real Estate: Investing in real estate, either directly or through REITs (Real Estate Investment Trusts), can provide steady returns and diversification.

- Mutual Funds: Like ETFs, mutual funds pool together money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets.

By building a diversified portfolio, you lower your exposure to market volatility, ensuring you can grow your money safely over time.

5. Understand Risk and Minimize Losses

No Beginner’s Guide to Growing Your Money Safely is complete without addressing risk management. While all investments carry some level of risk, there are strategies to minimize losses and grow your wealth securely:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, which helps you avoid trying to time the market.

- Rebalancing Your Portfolio: Regularly adjusting your portfolio ensures that it stays aligned with your risk tolerance and goals. If one asset class becomes too large or too risky, rebalance to maintain a safe mix.

- Avoid Emotional Investing: Many investors make poor decisions based on short-term market fluctuations. Stick to your long-term plan and avoid panic selling.

By understanding and managing risk, you can confidently grow your money safely.

6. Seek Professional Financial Advice

While this Beginner’s Guide to Growing Your Money Safely provides essential steps for beginners, consulting with a financial advisor can further enhance your investment strategy. Financial advisors can:

- Assess Your Risk Tolerance: A professional can help you determine how much risk you’re comfortable with and recommend investments that align with your goals.

- Create a Personalized Investment Plan: Financial advisors can create a tailored plan based on your financial situation, goals, and timeline.

- Monitor and Adjust Your Portfolio: Over time, your financial goals and market conditions may change. A financial advisor can help you adjust your portfolio to keep you on track.

By seeking professional advice, you’ll ensure that you’re growing your money safely and effectively.

- 7 Smart Saving Strategies: How to Boost Your Savings Without Sacrificing Lifestyle

- 7 Steps to Create a Financial Plan for Long-Term Security

- 10 Essential Personal Finance Tips for Building Wealth in 2024

Conclusion

Investing may seem intimidating at first, but with the right knowledge and strategies, anyone can start growing their money safely. This Beginner’s Guide to Growing Your Money Safely highlights the essential steps to begin investing, from setting clear financial goals to building a diversified portfolio. By understanding the basics of investing, choosing the right accounts, and managing risks, you’ll be well on your way to achieving financial success.

Start today with confidence, knowing that you can grow your money safely and build a secure financial future!