If you’re looking for ways to save more money but don’t want to sacrifice your lifestyle, you’re in the right place. Smart saving strategies allow you to increase your savings without giving up the things you love. These tips focus on optimizing how you manage your finances, helping you build a more financially secure future without feeling deprived. In this article, we’ll explore seven smart saving strategies that can help you boost your savings while maintaining your current lifestyle.

1. Track Your Spending Habits

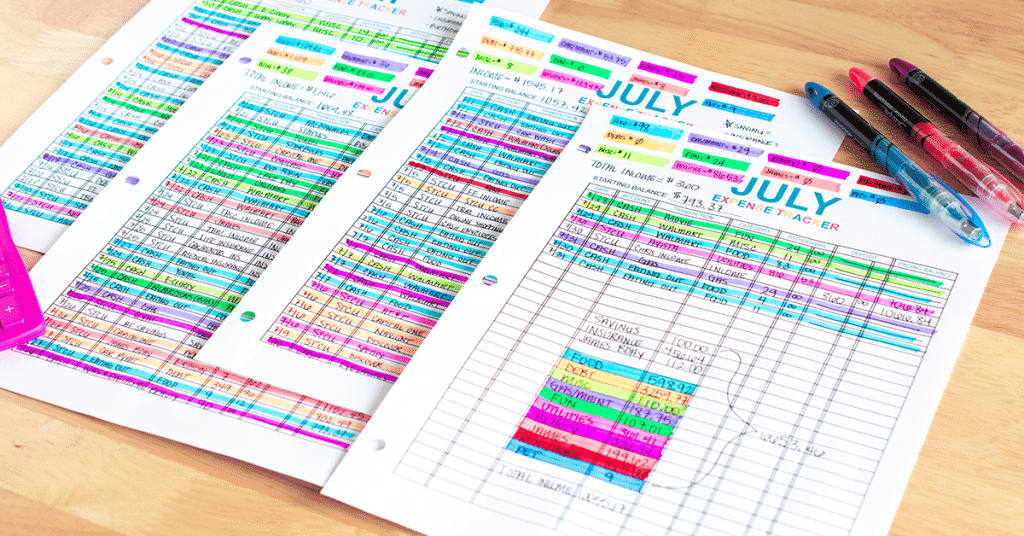

One of the most essential smart saving strategies is tracking your spending. Understanding where your money goes allows you to make informed decisions about your finances without feeling like you’re making sacrifices.

- Use Budgeting Apps: Apps like Mint or YNAB (You Need a Budget) help categorize and analyze your spending patterns. You can identify areas where you might be overspending and make adjustments accordingly.

- Create a Monthly Budget: Set limits for various categories like dining, entertainment, and transportation. Stick to these limits to ensure you’re saving money without feeling the pinch.

- Review Regularly: Revisit your budget every month and adjust as needed. Flexibility is key when implementing smart saving strategies.

By tracking your expenses, you can easily identify unnecessary purchases and channel that money into your savings.

2. Automate Your Savings

Another crucial smart saving strategy is to automate your savings. When you automate, saving becomes effortless, and you are less likely to spend money meant for your future.

- Set Up Automatic Transfers: Arrange for a portion of your paycheck to be automatically transferred to your savings or investment accounts.

- Choose a Savings Goal: Whether it’s an emergency fund, a vacation, or a new car, automating your savings towards a specific goal keeps you motivated.

- Utilize Employer Savings Programs: Some employers offer direct deposits into retirement accounts. Take full advantage of these programs as part of your smart saving strategies.

By automating, you remove the temptation to spend and ensure that your savings grow consistently over time.

3. Take Advantage of Cash-Back Programs

Incorporating cash-back programs into your daily routine is another effective smart saving strategy. These programs reward you for purchases you would make anyway, allowing you to save without changing your spending habits.

- Use Cash-Back Credit Cards: Choose a credit card that offers cash back on everyday purchases like groceries, gas, and dining. Ensure you pay off the balance monthly to avoid interest fees.

- Shop Through Cash-Back Websites: Websites like Rakuten or Honey offer cash back for shopping through their portals. Combining this with sales and coupons can increase your savings even further.

- Join Loyalty Programs: Many stores offer loyalty programs that give you points or cash back for frequent purchases. Take advantage of these to maximize your savings.

This smart saving strategy ensures you’re getting money back on essential purchases, allowing you to build your savings while maintaining your lifestyle.

4. Cut Down on Subscription Services

In today’s world, subscription services are everywhere, from streaming to fitness to meal kits. An essential part of smart saving strategies involves evaluating which services you actually use.

- Review All Your Subscriptions: Take inventory of all your recurring payments. Are you still using all those services, or could some be canceled without much impact on your life?

- Bundle Services for Discounts: Some companies offer bundled services at a reduced cost. For instance, if you have multiple streaming services, see if you can combine them to save money.

- Opt for Free Alternatives: Many paid services have free alternatives that provide similar benefits. Swapping a paid app for a free one can result in significant savings over time.

This smart saving strategy helps cut unnecessary costs while maintaining the core services you truly value.

5. Use Coupons and Discount Codes

Saving money while shopping doesn’t mean you need to cut back on purchases. Instead, use smart saving strategies like finding coupons and discount codes to pay less for the same products.

- Download Coupon Apps: Apps like RetailMeNot and Honey automatically find and apply discount codes at checkout, helping you save instantly.

- Subscribe to Newsletters: Many companies send exclusive discounts to their subscribers. Sign up for newsletters from your favorite brands to access deals.

- Wait for Sales: Patience is another smart saving strategy. If you can wait, most items go on sale eventually, allowing you to purchase them at a reduced price.

By incorporating coupons and discount codes into your shopping routine, you can maintain your lifestyle without overspending.

6. Make Smart Investments

One of the most powerful smart saving strategies is investing. When done right, investments can grow your wealth over time, providing you with more savings without any major lifestyle changes.

- Start with Low-Risk Investments: Consider starting with bonds, index funds, or ETFs (Exchange-Traded Funds), which provide steady returns without excessive risk.

- Reinvest Dividends: If you’re earning dividends from your investments, reinvesting them can accelerate the growth of your portfolio.

- Consult a Financial Advisor: For personalized advice on how to integrate smart investments into your savings strategy, consult with a financial expert.

Smart investing not only boosts your savings but also helps you secure long-term financial freedom while enjoying your current lifestyle.

7. Negotiate Your Bills

Negotiating your monthly bills is a lesser-known but highly effective smart saving strategy. Many companies are willing to offer discounts or better terms if you simply ask.

- Call Your Providers: Contact service providers like your internet, phone, and insurance companies. Ask for discounts, bundle offers, or lower rates.

- Compare Competitors: Research competitor pricing and use this information to negotiate better deals with your current providers.

- Use Bill Negotiation Apps: Apps like Trim or Truebill can negotiate bills on your behalf, ensuring you get the best possible rates.

By negotiating your bills, you can save a significant amount of money each month without cutting out essential services.

- 7 Steps to Create a Financial Plan for Long-Term Security

- 10 Essential Personal Finance Tips for Building Wealth in 2024

Conclusion

Saving money doesn’t have to mean sacrificing the lifestyle you enjoy. With these smart saving strategies, you can boost your savings while still living comfortably. From tracking your spending and automating your savings to negotiating bills and making smart investments, these strategies are designed to fit seamlessly into your everyday life. Start implementing these tips today, and watch your savings grow without feeling deprived.