In today’s fast-paced financial world, managing your money effectively is crucial for achieving long-term success. Whether you’re just starting out or looking to improve your financial habits, these personal finance tips for building wealth in 2024 can set you on the right path. By following these strategies, you’ll be better equipped to grow your wealth and reach your financial goals. Let’s dive into the 10 essential personal finance tips for building wealth that can make a real difference this year.

1. Create a Budget and Stick to It

One of the most important personal finance tips for building wealth is creating a solid budget. A well-planned budget helps you track your income, expenses, and savings goals. By setting spending limits and sticking to them, you can ensure that your finances stay on track.

- Track Your Income and Expenses: Use tools like budgeting apps to monitor where your money is going.

- Set Realistic Spending Goals: Make sure your budget is realistic, so you’re not tempted to overspend.

- Review Regularly: Review your budget monthly to adjust for any changes in income or expenses.

2. Prioritize Saving and Investing Early

When it comes to personal finance tips for building wealth, saving and investing as early as possible is key. The earlier you start saving and investing, the more time your money has to grow thanks to compound interest.

- Automate Your Savings: Set up automatic transfers to your savings account to ensure consistency.

- Explore Investment Options: Consider low-risk investments like index funds or ETFs to grow your wealth over time.

- Build an Emergency Fund: Before investing heavily, ensure you have at least three to six months’ worth of living expenses in a savings account for emergencies.

3. Avoid Unnecessary Debt

Debt can be one of the biggest barriers to building wealth. One of the core personal finance tips for building wealth is to avoid unnecessary debt and focus on paying off existing debt as quickly as possible.

- Use Credit Wisely: Only borrow what you can afford to repay, and avoid high-interest loans.

- Pay Off High-Interest Debt First: Focus on eliminating high-interest debts, like credit card balances, before anything else.

- Limit Big Purchases: Avoid unnecessary large purchases that require loans or financing, such as new cars or luxury items, unless absolutely necessary.

4. Invest in Yourself

Investing in yourself is an often overlooked, but vital, part of building long-term wealth. Whether through education, skills development, or improving your health, investing in yourself can lead to greater income potential and better financial habits.

- Pursue Higher Education or Certifications: Acquiring new skills can increase your earning potential.

- Focus on Health and Well-being: A healthier lifestyle can reduce long-term medical costs and improve productivity.

- Continuous Learning: Stay up-to-date with financial literacy and economic trends to make informed decisions.

5. Diversify Your Investments

Diversification is a fundamental principle of personal finance tips for building wealth. Relying on a single investment or asset class can expose you to unnecessary risk. Instead, spreading your investments across different types of assets can protect your wealth.

- Diversify Across Asset Classes: Consider a mix of stocks, bonds, real estate, and cash for a balanced portfolio.

- International Investments: Don’t be afraid to look beyond your local market and explore international options for greater diversification.

- Rebalance Regularly: Review and rebalance your portfolio to ensure it aligns with your risk tolerance and financial goals.

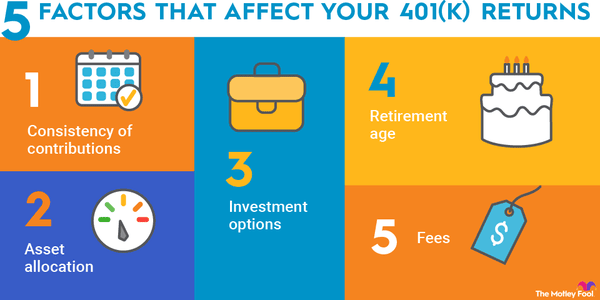

6. Maximize Retirement Contributions

One of the smartest personal finance tips for building wealth is to maximize your retirement contributions. Whether you have access to a 401(k), IRA, or other retirement plans, contributing the maximum amount allows you to take advantage of tax benefits and employer matching programs.

- Contribute to Employer-Sponsored Plans: Many employers offer matching contributions for retirement plans. Take full advantage of this “free money.”

- Consider Roth Options: Depending on your income level, a Roth IRA can be a tax-efficient way to save for retirement.

- Catch-Up Contributions: If you’re over 50, you may be eligible for higher contribution limits. Take advantage of this opportunity.

7. Set Short-Term and Long-Term Financial Goals

Clear goals provide direction and motivation. Having both short-term and long-term goals is a crucial element in the list of personal finance tips for building wealth.

- Short-Term Goals: Focus on goals like building an emergency fund, paying off debt, or saving for a vacation.

- Long-Term Goals: Plan for significant financial milestones such as buying a house, starting a business, or retiring comfortably.

- Review and Adjust: Life changes, so review your goals regularly and make adjustments as needed.

8. Live Below Your Means

One of the simplest yet most powerful personal finance tips for building wealth is to live below your means. By spending less than you earn, you create surplus cash flow that can be used for saving and investing.

- Practice Frugality: Look for ways to reduce everyday expenses, like cooking at home, canceling unused subscriptions, or opting for a more modest lifestyle.

- Delay Gratification: Instead of indulging in every want, focus on what truly matters and plan for bigger purchases when you can afford them.

- Boost Savings: The more you save now, the more you’ll have available for future investments.

9. Stay Informed About Tax Strategies

Taxes can significantly impact your ability to build wealth. One of the more advanced personal finance tips for building wealth is to understand and apply tax-saving strategies to reduce your taxable income and increase your overall savings.

- Maximize Deductions and Credits: Learn which deductions and credits you qualify for and make sure to use them.

- Take Advantage of Tax-Deferred Accounts: Retirement accounts like 401(k)s or IRAs allow you to grow your investments without being taxed until withdrawal.

- Consult a Tax Professional: Tax laws can be complex, so consider seeking professional advice to optimize your tax strategy.

10. Stay Disciplined and Patient

Building wealth takes time, and one of the most important personal finance tips for building wealth is to stay disciplined and patient. Financial growth doesn’t happen overnight, but consistent efforts will pay off in the long run.

- Stick to Your Plan: Follow your financial goals and budget closely, even when tempted to deviate.

- Avoid Get-Rich-Quick Schemes: Stay away from risky investments that promise instant wealth. True wealth is built steadily over time.

- Celebrate Milestones: Recognize and reward yourself for hitting financial milestones, such as paying off debt or reaching a savings goal.

Conclusion

By following these personal finance tips for building wealth, you can start 2024 with a solid foundation for financial success. Creating a budget, saving and investing early, avoiding unnecessary debt, and diversifying your investments are all crucial steps to achieving long-term wealth. Remember, building wealth takes time and dedication, but with these tips in mind, you’re well on your way to a prosperous future.