In today’s fast-paced world, finding ways to save money effortlessly is a game-changer. The benefits of round-up apps are quickly gaining attention for their ability to help users save money without the hassle of budgeting or tracking every penny. These apps round up your everyday purchases to the nearest dollar and set aside the spare change, allowing you to save while you spend. In this article, we’ll explore the benefits of round-up apps and how they can help you build a robust savings habit with minimal effort.

1. Automated Savings – A Hands-Off Approach to Building Wealth

One of the biggest benefits of round-up apps is the automated nature of the savings process. With round-up apps, every purchase you make is rounded up to the nearest dollar, and the difference is automatically added to your savings account. Here’s how it works:

- Effortless Saving: Once set up, round-up apps handle the saving process without requiring additional effort.

- Steady Growth: The small amounts add up over time, helping users accumulate savings they might not have otherwise set aside.

- Consistent Savings Habit: For those who struggle to save regularly, round-up apps provide a convenient way to build a savings habit without even realizing it.

2. No Impact on Your Budget – Save Without Sacrifice

Another of the notable benefits of round-up apps is that they enable you to save without impacting your budget significantly. Since the amount rounded up is usually just a few cents per transaction, it doesn’t create a noticeable dent in your spending.

- No Drastic Lifestyle Changes: You continue spending as usual, but now you’re saving money simultaneously.

- Ideal for Small Budgets: For those on tight budgets, round-up apps offer a practical way to accumulate savings gradually.

- Minimal Financial Disruption: With round-up apps, saving money becomes part of your everyday spending habits, allowing you to prioritize saving even when funds are tight.

3. Encourages Mindful Spending

A surprising benefit of round-up apps is the positive impact on your spending habits. Knowing that every purchase rounds up toward your savings can make you more mindful of your spending. Here’s how round-up apps can promote better financial awareness:

- Spending Awareness: When every purchase contributes to savings, you become more mindful of your spending patterns.

- Reduces Impulse Buying: The small saving action associated with each transaction may prompt you to evaluate purchases more carefully.

- Helps Track Spending Trends: Many round-up apps provide spending analytics, allowing you to see where your money goes and make informed adjustments if needed.

4. Compounded Growth Over Time

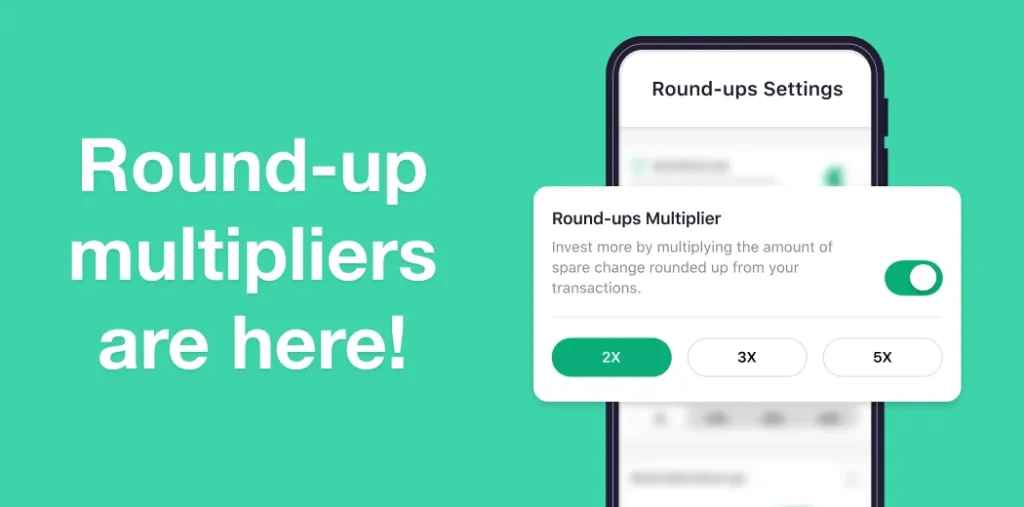

One of the most powerful benefits of round-up apps is the potential for compounded growth. As your round-up savings grow, they can be invested or transferred to interest-bearing accounts. Here’s how round-up apps can help your savings grow:

- Investment Opportunities: Many round-up apps offer options to invest your savings in stocks, bonds, or ETFs, allowing your funds to grow over time.

- Passive Income Potential: By leveraging compounding returns, your small round-ups can turn into a significant sum with consistent growth.

- Long-Term Financial Goals: Compounded growth can help you achieve goals like retirement savings, emergency funds, or even travel budgets without dedicating a large chunk of your income.

5. Easily Accessible and Beginner-Friendly

The benefits of round-up apps extend to accessibility and ease of use. These apps are designed for users of all financial backgrounds, making them ideal for those just beginning their savings journey.

- Simple Setup: Most round-up apps require just a few minutes to set up, linking directly to your bank account.

- User-Friendly Interface: With intuitive dashboards, round-up apps make tracking savings and monitoring growth easy.

- No Financial Expertise Required: Whether you’re a seasoned saver or new to managing finances, round-up apps provide a straightforward way to start saving.

Choosing the Best Round-Up App for You

With so many options available, it’s essential to find the app that offers the best benefits of round-up apps tailored to your needs. Here are some popular round-up apps to consider:

- Acorns: Known for its investing features, Acorns rounds up transactions and invests your spare change into diversified portfolios.

- Qapital: A savings-focused app, Qapital allows users to set specific savings goals, using round-ups and other rules to meet them.

- Chime: In addition to round-up savings, Chime offers other banking services and encourages savings with automatic transfers.

- Digit: This app analyzes your spending habits and uses round-ups as part of a broader savings strategy tailored to your financial profile.

Conclusion: Embrace the Benefits of Round-Up Apps Today!

The benefits of round-up apps are undeniable for those looking to save effortlessly while spending. With automated savings, minimal impact on your budget, and the potential for compounded growth, round-up apps provide an easy, effective way to build wealth. Whether you’re saving for short-term goals or long-term financial security, round-up apps can help you achieve these goals with minimal effort. Embrace the power of round-up apps today and watch your savings grow while you continue to enjoy your everyday spending.